The Pros and Cons of Renting vs. Buying Property in Nigeria

The decision to rent or buy property is a significant one, and it's influenced by a variety of personal, financial, and lifestyle factors. In the Nigerian real estate market, this decision becomes even more complex due to the diverse nature of property offerings and the unique economic and cultural dynamics of the country. In this blog post, we'll explore the pros and cons of renting versus buying property in Nigeria, helping you make an informed decision that aligns with your goals and circumstances.

Renting Property in Nigeria:

Pros:

-

Flexibility: Renting offers greater flexibility for those who may need to relocate for work or personal reasons. It allows you to adjust your living situation without the commitment of ownership.

-

Lower Initial Costs: Renting typically requires a smaller upfront financial commitment. You won't need to make a substantial down payment or invest in property maintenance.

-

Predictable Expenses: Monthly rent is a fixed cost, making it easier to budget for housing expenses. You won't have to worry about unexpected repair costs.

-

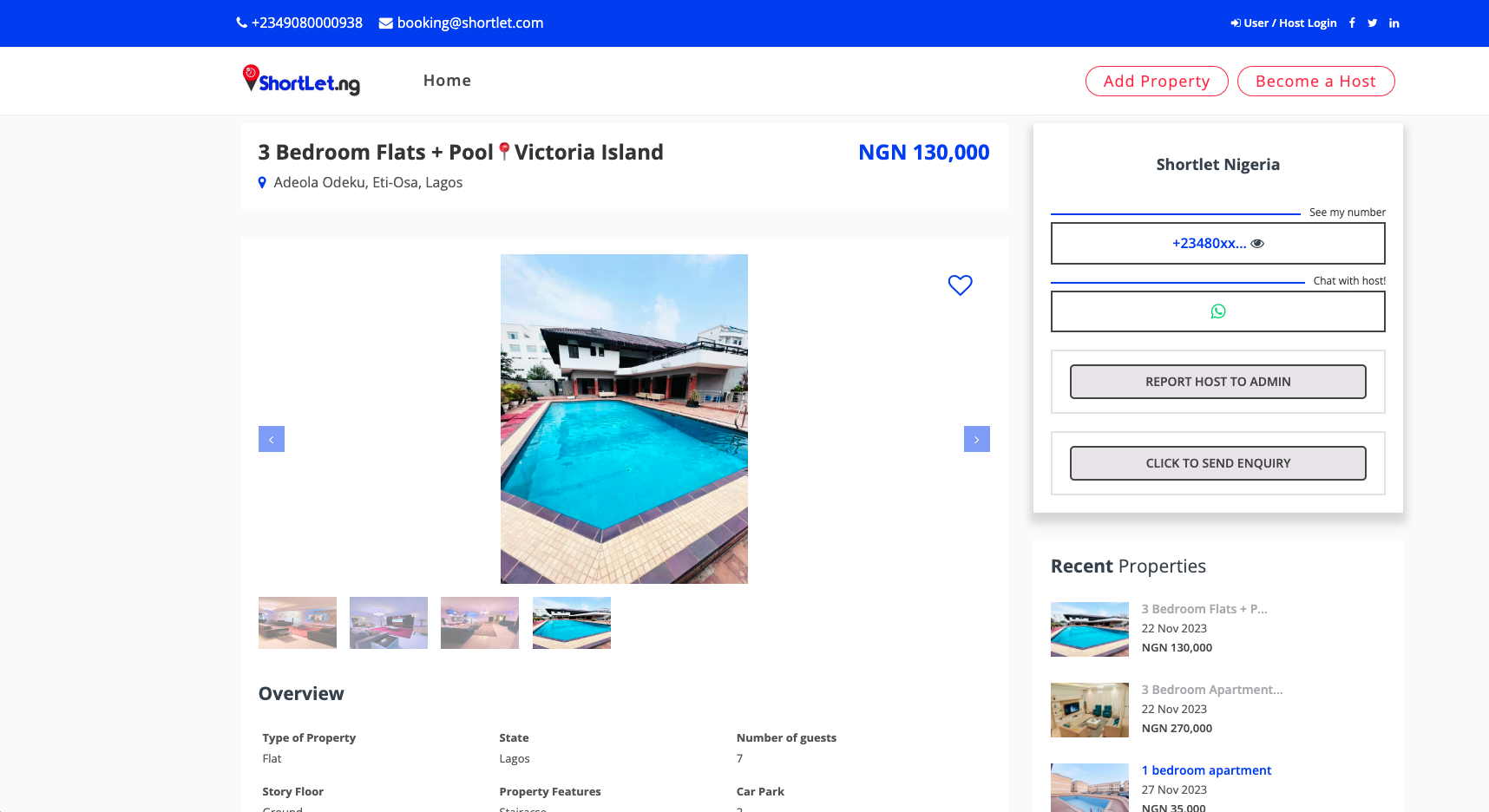

Amenities and Services: Many rental properties come with amenities and services, such as security, maintenance, and recreational facilities, which can enhance your quality of life.

Cons:

-

Lack of Equity: Renting doesn't provide the opportunity to build equity in the property. You're essentially paying for someone else's investment.

-

Limited Personalization: Renters may have restrictions on personalizing or modifying the property to suit their preferences.

-

Rent Increases: Landlords can increase rent prices, potentially making it less affordable over time.

Buying Property in Nigeria:

Pros:

-

Ownership and Equity: Buying property allows you to build equity over time, which can be a valuable asset for your financial future.

-

Stability: Homeownership offers stability and the opportunity to establish a permanent residence, giving you a sense of belonging in the community.

-

Property Appreciation: Historically, Nigerian real estate has shown the potential for property value appreciation, providing a potential return on investment.

-

Tax Benefits: Homeowners in Nigeria may enjoy tax benefits, such as reduced property and income tax liabilities.

Cons:

-

Higher Initial Costs: Buying a property in Nigeria typically requires a substantial down payment, legal fees, and ongoing maintenance expenses.

-

Responsibility for Maintenance: As a homeowner, you are responsible for property maintenance and repairs, which can be costly.

-

Limited Flexibility: Homeownership is less flexible than renting, making it harder to relocate when needed.

-

Market Volatility: The real estate market can be subject to fluctuations, affecting the value of your property.